Carbon Border Adjustment Mechanism Frequently Asked Questions

What’s the aim of the CBAM?

The aim is for the European Union to achieve net zero emissions by 2050 and for the EU to bear the responsibility of the emissions it is emitting in third countries.

REGISTRATION & RESPONSIBILITIES

CBAM applies to individuals and companies that import certain goods from outside the EU into the EU, with a customs value over 150€. For the complete list of CN codes that fall in scope of CBAM, kindly consult the Annex attached at the end of this document.

If you are subject to the CBAM obligations, you are required to register.

To register to CBAM, download the registration form that applies to you (for Companies or for Individuals) which you can find at https://www.climateaction.gov.mt/cbam/

Fill the form and send it to cbam.caa@climateaction.gov.mt with the required documentation. We will process your application and give you access to the CBAM portal where you will be able to create your reports.

The CBAM regulation applies only to certain goods made from Iron & Steel, Aluminium, Cement, Fertilizer, Chemicals and Cement, originating from non-EU countries (except for Iceland, Liechtenstein, Norway, Switzerland, Büsingen, Heligoland, Livigno, Ceuta, Melilla), and of a value of €150 or over.

No, this Regulation applies only to CBAM goods originating in third countries and imported into the customs territory of the Union. CBAM goods produced in the EU countries are not subject to CBAM reporting obligations.

However, if relevant precursors of CBAM goods produced in the EU are used to produce CBAM goods in third countries, the embedded emissions of those precursors also must be accounted for in the determination of the embedded emissions.

This value applies per consignment, meaning it is the total amount per import. For instance, if you import an item totalling 130€ and subsequently import the same item on a separate customs declaration costing 200€, you only need to report the import valued at 200€.

If you have two CBAM goods which the sum value equals or goes over 150€, on the same consignment, you need to report both goods, even though their value alone is below 150€.

Please note that the Commission will act in accordance with Article 27 of Regulation (EU) 2023/956 on Circumvention.

Practices of circumvention shall be defined as a change in the pattern of trade in goods, which stems from a practice, process of work, for which there is insufficient due cause or economic justification other than to avoid, wholly or partially, any of the obligations laid down in this Regulation. Such practice, process or work may consist of, but is not limited to:

(a) Slightly modifying the goods concerned to make those goods fall under CN codes which are not listed in Annex I, except where the modification alters their essential characteristics;

(b) artificially splitting shipments into consignments, the intrinsic value of which does not exceed the threshold referred to in Article 2(3).

The way the system works does not allow us to extract import information provided to customs through the CBAM portal. Moreover, the approach taken by the commission is that cross-checks between customs data and information provided through the CBAM portal will be carried out for verification.

Under the CBAM Regulation, the National Competent Authority has the right to apply penalties where a reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report, or where the CBAM report is incorrect or incomplete, and where the reporting declarant has not taken the necessary steps to correct the CBAM report where incongruencies in the report have been identified.

If the reporting declarant does not register in the Transitional Registry, it will be impossible to comply with the CBAM reporting obligations. Therefore, registration is compulsory as well. When a declarant does not register, this does not by itself trigger the application of penalties. However, if not registered, the declarant will not be able to submit a CBAM report, which can be penalised for non-reporting.

If a penalty is not paid by the declarant, NCAs can take legal action according to national law.

While the Implementing Regulation does not say this explicitly, it is evident from the Article 26(5) of the CBAM Regulation, which states: “Where the penalty has not been paid by the due date […], the competent authority shall secure payment of that penalty by all means available to it under the national law of the Member State concerned.”

Please note that the CBAM regulation does not apply to raw materials only. There are 6 categories of goods that fall within scope of CBAM. For the full list of CBAM goods, please refer to the Commodity Code List to check whether the goods you import fall in the CBAM scope (See Annex 1 of this document). Also note that the goods need to have a customs value exceeding 150€ and are imported from outside the EU (except for Iceland, Liechtenstein, Norway, Switzerland, Büsingen, Heligoland, Livigno, Ceuta, Melilla)

When only the first four numbers are indicated it means that any good having the CN number starting with those numbers is included in the CBAM regulation and, hence, need to be reported unless they fall into the clearly mentioned exceptions.

It is likely that, with time, more goods will be added to the list.

No, ‘Electricity’ refers to the actual import of electricity from power plants or alternative sources. Malta imports its electricity from Italy (EU); hence no one is expected to apply as electricity importer.

The registration to CBAM should be done in the Member State where the reporting declarant is established. If you are the one reporting, then you should register in Malta through the CAA. If the customs representative is the responsible for CBAM reporting, then he/she should register in his/her country of establishment.

The CBAM registration and the CBAM reporting must be submitted to the National Competent Authority of the Country where the customs declaration is lodged.

Yes, this is possible.

If you would like to represent multiple companies owned by the same group/owner, and you are employed with one of the companies, you can register as an Indirect Customs Representative, using the EORI of one of the companies.

If you would like to represent multiple companies but you are employed with an external company who would like to provide the service to several other companies, then you will need to register as an Indirect Customs Representative, using the EORI of the company you work with.

Individuals acting as Indirect Customs Representatives may register using their own private EORI, however this is NOT RECOMMENDED.

Please note that companies or individuals who wish to act as Indirect Customs Representative must fill in a Registration Form separate from the one being submitted by the Companies who are doing the actual import. Companies who wish to be represented by an Indirect Customs Representative may decide to not register their company with the MRA. We do, however, advise that the company does register at least one person from within the company as Economic Operator, in the case that the Indirect Customs Representative suddenly cannot report for whatever reason. Remember that the final responsibility of reporting lies with the importer. Having said that, the final decision lies with the importing company.

The final responsibility lies with the Importer. If incorrect/incomplete/late reports are submitted, or if no reporting is done, the importer will have to bear the responsibility. Hence, if the importer decides to nominate an external Indirect Customs Representative to lodge reports on their behalf, the importer must ensure that the report being submitted is correct and complete, and that it will be submitted on time. The Indirect Customs Representative has the opportunity to provide a copy of the report that is being submitted prior to final submission.

Please contact us at cbam.caa@climateaction.gov.mt so that we can update the records.

An employee of an importing company is considered the ‘importer for all goods’ if they are reporting only for the company they work for (economic operators)

Contact us at cbam.caa@climateaction.gov.mt with your request to delete your account, and we will initiate the procedure for the account deletion. Kindly note that the retention of personal data will be treated in line with the GDPR.

MISSED REPORT SUBMISSION

Register with CAA to get access to the CBAM portal as soon as possible, you will have time to submit the reports you missed until the end July 2024.

To request a delay submission for the first time, click on the ‘Request Delay’ button on the right of the Quarterly Report you need to submit and indicate ‘Requested by Declarant (technical error)’. The request is approved automatically.

In order to request for successive delays, please, follow the steps outlined below:

1. Access the CBAM portal through this link: https://cbam.ec.europa.eu/declarant/

2. Go to ‘Requests’

3. Click on ‘Create Request’

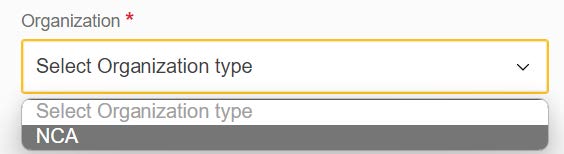

4. Select ‘NCA’ in the Organization field

5. As a Title use ‘Request delayed submission for QX YYYY’ where X is the quarter number and YYYY is the year of the reporting period you need to complete.

6. For the type of request select ‘Request for Information/Documents’

7. Priority medium

8. The due date should be one week from the day of the request.

9. In the message mention that you request a delayed report submission for QX YYYY giving a reason for the delay and listing your details including i) Company name ii) EORI number iii) Name and Surname iv) ECAS email and username

10. Then click on ‘Create Request’, on the top right side of the page.

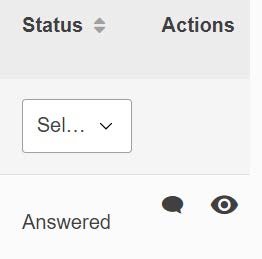

We will then process your request from the system. Once the request is received and a reply is provided, the status will change to ‘Answered’ and you can then see the reply by:

11. Access the CBAM portal through this link: https://cbam.ec.europa.eu/declarant/

12. Go to ‘Requests’

13. Click ‘Outgoing’

14. Click on the eye icon at the right side of the request

15. Scroll down to the Response where you will receive a reply with the reference number.

Once you have the reference number you can go back to ‘My Quarterly Reports’ and ask for a delay using that reference number.

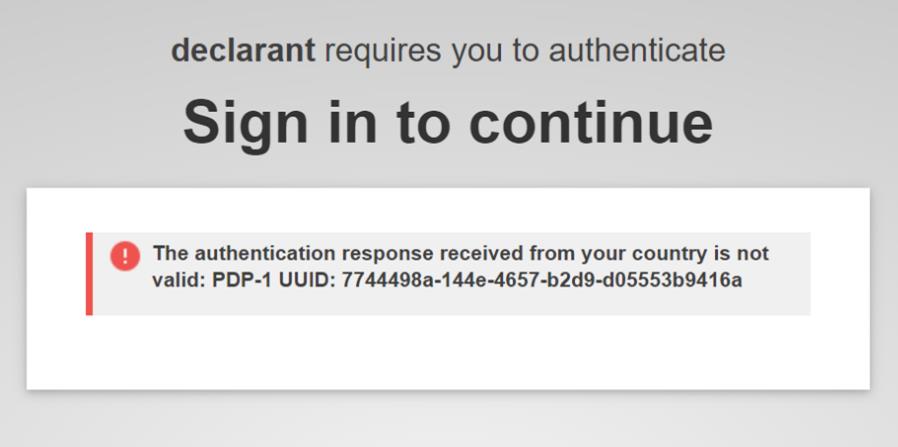

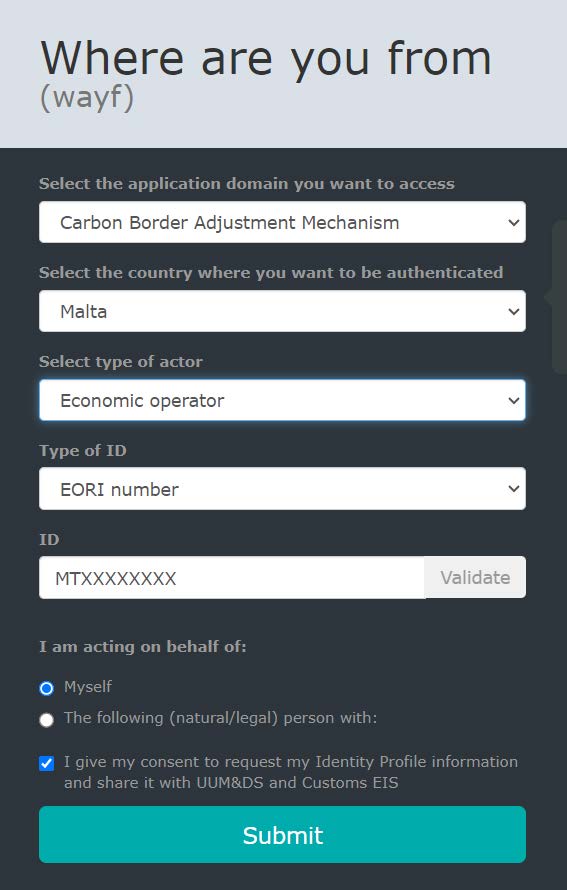

LOGIN ISSUES

Please make sure that you are trying to access the right portal:

PRODUCTION (Official) https://cbam.ec.europa.eu/declarant/ for the actual report

CONFORMANCE (Testing) https://conformance.cbam.ec.europa.eu/declarant for testing the portal.

Also, make sure you select the proper ‘Type of actor’, which can be either ‘Economic operator’ or ‘Customs representative’.

In the ID field enter the EORI (VAT) number with no spaces nor dashes. Select ‘I am acting on behalf of:’ ‘Myself’ and tick the last box.

Finally, click ‘Submit’.

Sometimes the system memorises the wrong access information provided and, as a result will deny your access. In this case, clean the browser cache and restart the browser. If this doesn’t work, try restarting the computer.

Moreover, the website may also not respond correctly due to maintenance and/or update.

If the issue persists, please contact us at cbam.caa@climateaction.gov.mt

REPORTING

The commission has developed a Communication Template to facilitate the exchange of information required for you to submit the CBAM Report. Please note, that this document is solely for you and your manufacturer, and it is not valid as report. The data from the last three tabs (Summary Processes, Summary Products, Summary Communication) will need to be transferred to the CBAM portal manually. There is currently not guidance available on the communication template – official guidance from the Commission should become available by end of year. Having said that, the NCA is preparing the necessary training to be delivered soon.

The Commission is preparing guidance documents in various languages. Kindly keep an eye out for these on the Commission’s CBAM webpage, under the Guidance section: Carbon Border Adjustment Mechanism – European Commission (europa.eu). Versions in languages other than English are being made available.

The Commission has published Default Values for the transitional period which can be used instead of the actual supplier data that you need to get through the communication template. However, these default values can only be used until the end of July 2024. After that, actual manufacturer data will be required.

Please note that this regulation is relatively new for everyone, and some suppliers may still be unaware of it. However, if they provide CBAM goods to other European importers, then they will need to furnish this information to other importers.

You should get your data either through your distributor (which will need to contact the manufacturer himself) or by contacting the manufacturer yourself (for this you will need to ask the distributor to provide you with their contact information).

In the list of Import Procedures you can find the description of each type. The import procedure is also indicated in the customs declaration. If you are still unsure, please contact Customs to identify which import procedure applies to your imports.

In the CBAM portal, you are able to report imports of the same CN code under one item. You will however need to specify the different Country of Origin, import procedures and net mass (and unit) on the Goods Imported page (by clicking the Add new button just above the first grey box, and on the Emissions Section (by clicking on the Add an Emission button displayed on the left-hand side of the screen). You should have the same number of emission entries as you had specified in the Goods Imported Section.

If you have imported the same CN code from the same country but from different suppliers, and you are reporting using default values, you will be able to enter all the emissions as a sum into one Emissions Tab. This is applicable only during the Transitional Period and when using Default Values.

In the portal, you must select the code from the dropdown list after you input the first 4 digits, otherwise it will give an error. If the CN code is in the CBAM Regulation list but is not showing on the portal, you should report this issue to us for further action on cbam.caa@climateaction.gov.mt.

From 2025, the Commission will be registering Operators of installations in Third Countries. The list of operators of installation will become available as a drop-down menu in the Installations Tab of the CBAM portal. CBAM declarants will have the opportunity to choose the relevant operators from that list – this will, however, become available at a later stage (late 2025-2026). Since this functionality is not yet available, the information on the operators/installations is not mandatory.

For the time being, leave this section empty and make sure to delete any fields related that were opened.

No, if you have not imported any CBAM goods during that particular quarter, you should not report anything.

We appreciate the difficulties you are encountering, and we are working with the Commission to facilitate the process.

MRA is also organising online and in-person workshops demonstrating how to report using the CBAM Portal.

For specific issues you can contact us at cbam.caa@climateaction.gov.mt

If you notice that you have missed reporting an import during a quarter whose reporting period has elapsed, you might not be able to amend your report, as the reporting portal for reporting quarters closes once the reporting period is over. If you had requested a delay for that quarter, you might however be able to do so. You will need to check if you are able to amend your report by clicking on the report number in blue and check whether you have an Amend button at the top. For future reports, kindly make sure to submit correct reports, as amendments will not be possible after the report submission deadline.

Once the review has been carried out by the Commission, importers will also be notified in case of incorrect/incomplete data and will have the chance to rectify the report accordingly, at that stage.

The temporary admission procedure is not in the scope of CBAM and not considered an import as per CBAM provisions. Hence, such goods shall not be reported under CBAM. Goods are in scope of CBAM when they are not re-exported after their usage and are declared for free circulation. In this case, such goods must be reported in the CBAM report.

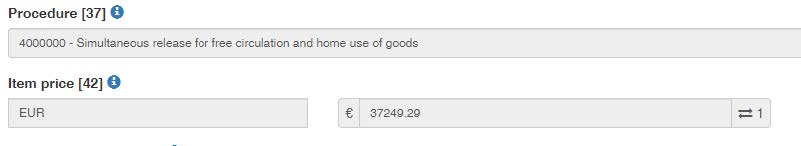

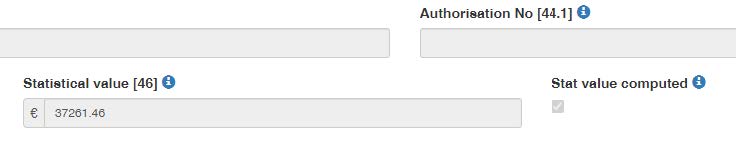

You must always use the data entered in the Customs declaration. The Commission will be conducting reviews and cross-checking the information you have entered on the CBAM portal with the information of the Customs Declarations. Make sure that the commodity codes reported on the customs declaration are correct.

All goods falling within scope of CBAM, imported during a certain quarter, will all need to be reported in a single report.

For instance, goods falling under the CBAM Regulation, imported between January and March 2024, will all have to be reported in the Q1 2024 Report.

Currently, this functionality is not available on the CBAM portal. However, you can download a copy of the submitted report as .pdf and split it using an online PDF splitter.

In cases where couriers are lodging customs declarations for you, ensure that they specify the correct item price (excluding shipping price) on the customs declaration form.

The EU customs legislation and hence the customs import system (NIS) allow a declarant to declare value either as C&F (cost and freight) or FOB (freight on board) indicating that the transport charge is included in the freight charges field.

The item price (box 42) excludes shipping cost. The statistical value (box 46) includes shipping cost. If the invoice does not include the item price (i.e. excluding shipping), the courier will not be able to report the item price (without shipping).

If you import goods from non-EU countries, to be assembled in Malta and then exported/released into other EU countries for free circulation, your goods will fall under the inward processing procedure, and customs import procedure 4000000 (aka ‘four million’). When reporting the import of the goods being used for such purposes, on the CBAM portal, you will need to report them under Import Procedure 40 and tick the box ‘Inward Processing’.

THE DEFINITIVE PERIOD

No. The purchasing of certificates will initiate in 2026, during the Definitive Period. In 2025, the process of applying for and obtaining authorisation will initiate. From 2026, importers who fail to register and obtain authorisation will be blocked from importing goods into Malta. Only Authorised declarants will be able to start purchasing and surrendering CBAM certificates in 2026.

During the transitional period importers will have the opportunity to understand their emission levels. Each submitted report will show the total emissions generated by the production of the goods you purchased. Currently, the cost of 1 tonne of CO2 ranges between 50 and 70 euros on average. By multiplying the cost per tonne of CO2 by your total emissions, you can estimate the number of certificates you will need to purchase. 1 certificate will be equivalent to 1 tonne of CO2.

No, the price of CBAM certificates shall be calculated by the Commission and will be based on the weekly average auction price of the EU ETS. The price fluctuates, and it is more likely for the price to increase over time.

For every quarter, the importer/reporting declarant will need to estimate the number of embedded emissions of their imported goods. According to this value, they will need to purchase at least 80% of that amount in certificates by the end of each quarter. At the end of the year, they must make sure that they have purchased enough certificates to cover the total amount of emissions for that year.

By 31 May of each year (for the first time in 2027 for the year 2026), the authorised CBAM declarant will surrender, via the CBAM registry, a number of CBAM certificates that corresponds to the number of embedded emissions declared during the previous year.

By 30 June of every year, an authorised CBAM declarant may request to repurchase any CBAM certificates that were bought in excess. The price of these certificates will be equal to the price they were purchased at, irrespective of the price of the CBAM certificates at the time of repurchase. On 1 July of each year, the Commission will cancel any CBAM certificates that were purchased during the year before and that remained in the account of an authorised CBAM declarant. These certificates will be cancelled without any compensation.